If you’re an entrepreneur with a great idea for a business venture, at some point you need to decide whether to incorporate. Choosing to incorporate can help you protect you as your small business grows. On the other hand, you may only require a simple structure and want to register your business as a sole proprietorship. Whichever you decide on, it’s important that the business structure of your new company reflects your goals for the future. To choose the right business structure, you should not only understand the benefits of each but also the setup costs as well as financial and legal implications. Determining whether to register your new business as a sole proprietorship vs. corporation can be difficult, but Ownr is here to make it easier.

What is the difference between a sole proprietorship and a corporation?

The main difference between a sole proprietorship and a corporation is liability and taxation. A sole proprietorship has unlimited personal liability and is taxed as personal income. A corporation limits liability to business assets and is taxed separately. Corporations also require more regulations and formalities.

Sole proprietorships and corporations are two business structures available to Canadian entrepreneurs and each has their own benefits and drawbacks. We’ll cover these in more detail, but here are the most important points:

| Sole Proprietorships | Corporations | |

| Features |

|

|

| Benefits |

|

|

| Drawbacks |

|

|

As you can see, a sole proprietorship is the simplest business structure. There is only one owner who files a personal income tax return for all profits earned. There is no legal distinction between the business and the owner, meaning that any financial or legal obligations are the sole responsibility of the owner.

A corporation, on the other hand, separates the owner from the business, and defines the business as its own legal entity. The owner is not personally liable for the business’s financial and legal responsibilities and also benefits from its corporation status through advantages like lower business tax rates and easier access to capital.

It’s worth noting that sole proprietorships and incorporations are not the only business structure options. You can also consider cooperatives, nonprofits, and general partnerships (which are very similar to a sole proprietorship but with two or more owners).

Sole proprietorship: benefits and considerations

Sole proprietorships are the most common form of business organization in Canada. Let’s first explore what this business structure is and why so many Canadians choose to register their business as a sole proprietorship.

What is a sole proprietorship?

Simply put, a sole proprietorship is a business structure in which an individual owner of a business takes on all the legal responsibilities, profits and debts of the company.

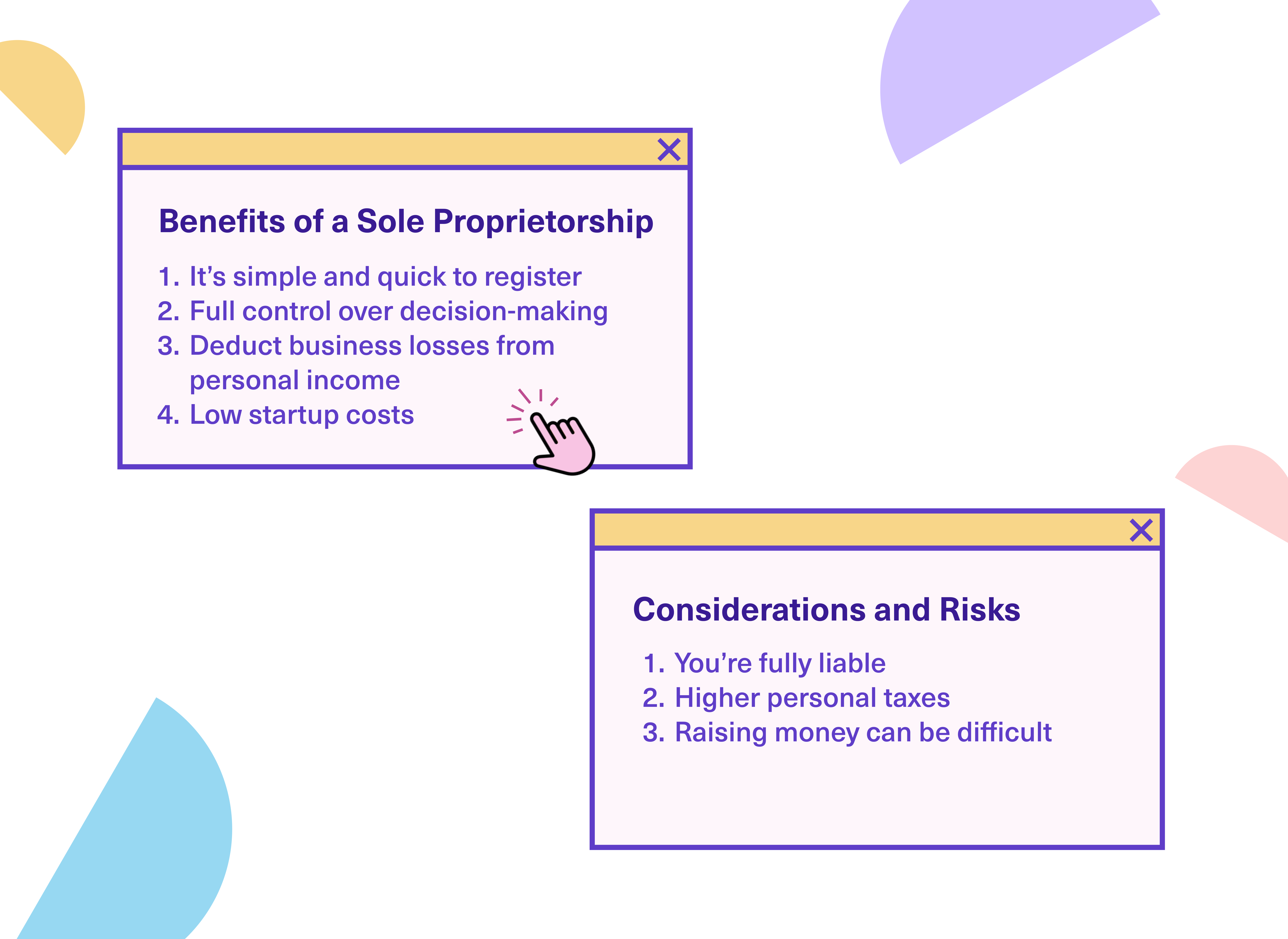

Benefits of a sole proprietorship

There are many benefits of registering your business as a sole proprietorship.

1. Simple and quick registration

Registering as a sole proprietorship is the simplest business structure. Setup can take mere minutes if you choose to register your business as a sole proprietor with Ownr.

2. Full control over decision-making

By registering as a sole proprietor, there’s no need for board or shareholder approvals. As the sole owner, you have complete control over the company’s business decisions.

3. Deduct business losses from personal income

The ability to claim business deductions for your company’s losses will help you, as the owner, remain in a lower personal income tax bracket.

4. Low startup costs

Registering your business as a sole proprietorship has the lowest associated costs. Register your business with Ownr for a one-time fee of only $49.

Considerations and risks of a sole proprietorship

While sole proprietorships have many benefits, there are trade-offs to consider as well. Here are some of the cons of a sole proprietorship.

1. You’re fully liable

If your business incurs debt, you are personally responsible. It’s that simple.

2. Higher personal taxes

If your business becomes super profitable, you’ll personally pay higher taxes. While high profits are certainly a benefit, it’s important to know you may jump to a higher tax bracket as your business’s finances improve.

3. Raising money can be difficult

Sole proprietors can have more difficulty raising capital than incorporated businesses. Financial institutions and investors may require your business to be incorporated before they give you a loan or make an investment.

Incorporation: benefits and considerations

Incorporation is the third most common type of business (after sole proprietorship and general partnership agreements) with many entrepreneurs starting out with sole proprietorships before incorporating. Here are the most common reasons why entrepreneurs make the leap from sole proprietorship to incorporation.

What is an incorporation?

An incorporation is a business structure in which the company operates as its own legal entity. Once you decide to incorporate your business, it’s no longer simply an extension of your work and income; it becomes its own distinct legal entity separate from the owners. Incorporation provides greater liability protection for you as a business owner than sole proprietorships or general partnerships. Before deciding to incorporate, you’ll also have to choose whether to do so under provincial law or federal law. Let’s look at some of the advantages and disadvantages of incorporating your business.

Benefits of an incorporation

There are many advantages to registering your business as a corporation.

1. Limited liability

This means your exposure to any retribution as a business owner—should your business not do well and incur debts or losses—is limited. In most cases your personal assets cannot be seized for debts incurred by the business. Corporations are separate legal entities and owners are not personally responsible for the business’s financial and legal liabilities.

2. Ability to transfer ownership

Once incorporated, owners have the ability to transfer ownership should they decide to sell the business.

3. Easier to raise capital

Incorporating a business opens the door to additional financing. You’ll have more funding opportunities because you have the option to sell shares, making it easier to raise capital from investors and financial institutions.

4. Legacy and estate planning

An incorporated business theoretically exists forever and will be treated as an asset that lives beyond the life of the owners to eventually be taken over by a beneficiary. It’s important as a business owner to create an estate plan for the beneficiary of the business so affairs are in order and they are not left with heavy taxation.

5. Lower tax rates

A corporation’s business income will be taxed at the federal or provincial corporate tax rate. The corporate tax rates, in general, are lower than personal income tax rates. Corporations can also benefit from additional tax deductible business expenses.

Considerations and risks of an incorporation

Though there are extensive benefits to incorporating, there are also risks. It’s important to consider the following concerns.

1. Stricter regulations

Once incorporated, your business must abide by strict regulations that require accurate paperwork.

2. More fees and higher costs

The startup costs of setting up a corporation are higher than a sole proprietorship. The cost of registering your business as a sole proprietorship is generally under $100 ($60-$80 for the registration fee, plus additional fees for your official business name search). Incorporation costs start at around $200 for a federal incorporation fee and can cost as much as $350 for provincial incorporation based on the province or territory. Additional fees for the business name search will also apply.

3. Potential for internal conflict with shareholders

Including shareholders and directors in your small business opens up the potential for internal conflict and disagreements.

4. Additional (and ongoing) paperwork filings

There’s a lot more paperwork involved with corporations, including yearly documentation that must be filed with the government. You must maintain ongoing paperwork filings to continue to operate.

5. Additional legal formalities

The formality of filing “articles of incorporation” may sound daunting but it doesn’t have to be as overwhelming as you might think. Read on for more information on articles of incorporation or check out Ownr’s complete guide to articles of incorporation.

What are articles of incorporation?

Articles of incorporation are legal documents that describe the structure of your business. They are what defines your business as a separate legal entity. If your business is incorporated federally, the governing agency is the federal government of Canada and if incorporated provincially, it is the provincial or territorial government.

Articles of incorporation also ensure that your business is following certain rules concerning ownership of your company. For instance, both provincial and federal corporations must meet certain director residency requirements that stipulate that at least 25 per cent of a company’s directors be a citizen or permanent resident of Canada. Note that if your company has less than four directors, then at least one director must be a citizen or permanent resident of Canada.

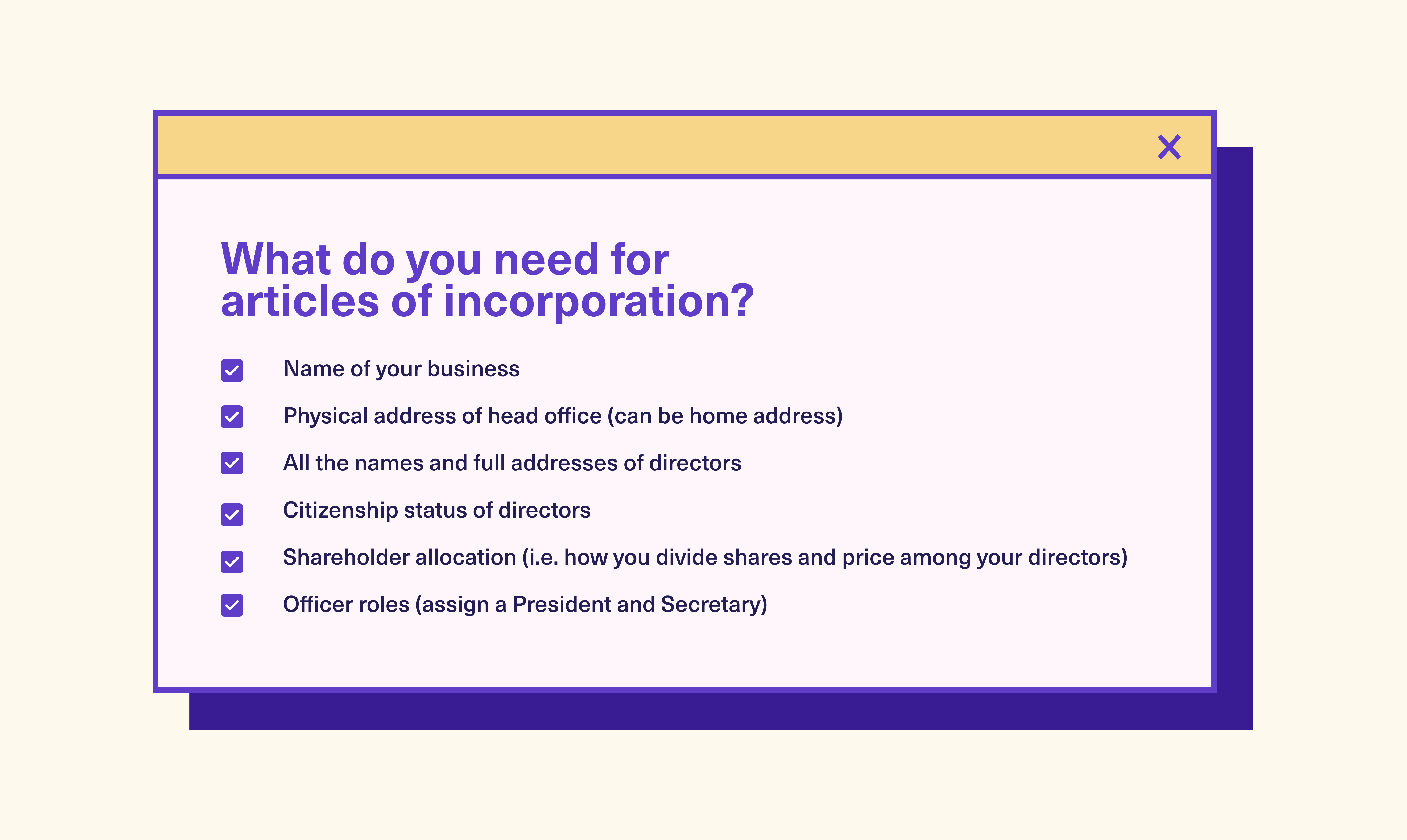

What do you need for articles of incorporation?

Below is the information you’ll need to prepare in order to file your articles of incorporation—a process that Ownr guides you through when you create an account and incorporate your business.

- Name of your business

- Physical address of head office (can be home address)

- Full names and address of all directors

- Citizenship status of directors

- Shareholder allocation (i.e. how you divide shares and price among your directors)

- Officer roles (assign a President and Secretary)

Do I need articles of incorporation for a sole proprietorship?

If you are registering your business as a sole proprietorship, you do not need articles of incorporation. Articles of incorporation are only necessary for a corporation as it they are documents that define the company as a separate legal entity.

Should you choose a sole proprietorship or incorporation?

When to choose sole proprietorship

If you are experimenting with a new business idea and are not sure whether you will pursue it long term, a sole proprietorship may be your best option. As a sole proprietor, you can operate under a unique business name with a simple tax structure without incurring high startup fees or investing a lot of time and effort to set up your business.

When to choose incorporation

If your business has more than one owner or is growing at a fast rate and you have long term plans for it, you may want to consider incorporating. You’ll benefit from the limited liability, preferable tax rates, and the capacity to raise capital more easily.

If you want to know when the best time to incorporate your business is, we recommend sooner rather than later. Establishing credibility as a business takes time, and incorporating helps build it. Many customers, suppliers and lenders prefer to do business with established businesses, with some lenders requiring a business to have been operational for some time to be considered for loans.

Starting your own business is an incredible opportunity for your entrepreneurial dreams to become a reality. As you begin this journey, you’ll be faced with many important decisions, including whether or not to incorporate.. However you choose to structure your business, Ownr makes the process seamless and easy, giving you more time and energy to concentrate on growing your business.

Frequently asked questions about corporations vs sole proprietorships

What is the main advantage of owning a sole proprietorship over a corporation?

The main advantage of owning a sole proprietorship over a corporation is the simplicity of the business structure. It can be set up quickly and cheaply, and you don’t have to worry about complicated documentation and filings.

What is the biggest disadvantage of a sole proprietorship?

The greatest drawback of sole proprietorships is the exposure to liability. Since a sole proprietorship isn’t a distinct legal entity, any legal or financial liabilities incurred by the business are automatically the responsibility of the business owner.

Do corporations pay less tax than sole proprietorship?

Yes, corporations generally pay less in taxes than sole proprietorships since they can enjoy the benefits of corporate tax incentives.

Do you save money by incorporating?

It’s possible to save money by incorporating, since your business will be subject to lower corporate tax rates. However, the direct costs of setting up a corporation are higher than those associated with setting up a sole proprietorship.

Can a sole proprietorship be incorporated?

Yes, if you already have a sole proprietorship you can incorporate your business.

What is the difference between a sole proprietorship and an LLC?

LLC stands for limited liability company, an American business structure that is not available to Canadians. A corporation is the Canadian analog to an LLC.

Can I be a sole proprietor and have an incorporation?

You can only be a sole proprietor and the owner of a corporation if the two businesses are separate. A sole proprietorship can’t be a corporation at the same time, since incorporating creates a separate legal entity.

What’s the difference between INC and LTD?

Inc and Ltd are common suffixes in the names of Canadian corporations. Usually, there isn’t an important distinction between them.

This article offers general information only, is current as of the date of publication, and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.